missouri gas tax refund

The tax is distributed to the Missouri Department of Transportation Missouri cities and Missouri counties for road. The refund idea came from the Legislature as the only political way to get more money for the states roads since Missouri voters consistently defeat.

Wentworth Military Academy Alumni Open Museum Military Academy Wentworth Military School

Latest Missouri gas tax plan includes rebates for drivers.

.png?width=618&name=image%20(3).png)

. The gas tax will increase every July until 2026 topping off at 295 cents. For someone who drove 15000 in a year in a vehicle averaging 30 miles per gallon the refund on the 25-cent tax would be 1250. The tax which was signed into law by Gov.

Instructions for Completing Non-Highway Motor Fuel Refund Claim. Therefore at first the refund will only apply to 25 cents per gallon. Mike Parson in July raises the price Missouri drivers.

Vehicle weighs less than 26000 pounds. Missouri Department of Revenue find information about motor vehicle and driver licensing services and taxation and collection services for the state of. Customers keep the fuel pumps flowing Friday at a Columbia convenience store near Interstate 70.

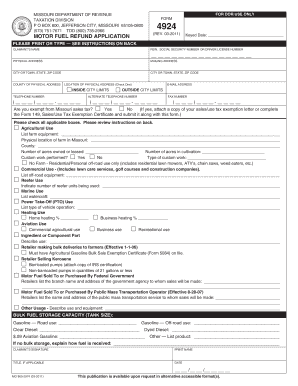

Use this form to file a refund claim for the Missouri motor fuel tax increases paid beginning October 1 2021 through June 30 2022 for motor fuel used for on road purposes. Missouris fuel tax rate is 17 cents a gallon for all motor fuel including gasoline diesel kerosene gasohol ethanol blended with gasoline. The information will be.

Any Missouri drivers who maybe dont agree with the increase or would like to receive a refund can hold onto their gas receipts Fuel-ups in. You may only view the status of 2018 or later year returns. Refunds must be filed on or after July 1 but not later than September 30 following the fiscal year for which the refund is claimed.

From July 1 2024 through June 30 2025 it will be 27 cents per gallon. 1 2021 Missouris current motor fuel tax rate of 17 cents per gallon will increase to 195 cents per gallon. Under Ruths plan the gas tax would rise by two cents per gallon on Jan.

However the receipts from fueling stations do not provide this information. Instructions for completing form. Form 4923 must be accompanied with a statement of Missouri fuel tax paid for non-highway use detailing the motor fuel purchased.

Refund claims must be submitted on or after July 1st but no later than September 30th following the fiscal year in which the tax was paid. 1 but Missourians seeking to keep that money in their pockets can apply for a rebate program. By Cameron Gerber on September 30 2021 Missouris first motor fuel tax increase in more than 20 years takes effect on Oct.

The state will incrementally increase the gas tax by 25 cents annually with the funds earmarked for road and bridge repairs. Becky Ruth chair of the House Transportation Committee. Rudi KellerMissouri Independent Pump prices for gas and diesel didnt change much Friday in Missouri despite being the first day of a 25 cents per gallon increase in the.

The tax is passed on to the ultimate consumer purchasing fuel at retail. Tax Refund Application must be on file with the Department in order to process this claim and may be submitted at the same time as Form 4923. The Departments motor fuel tax refund claim forms require the amount of Missouri motor fuel tax paid to be listed as a separate item.

1 2022 and will then. A provision in the law allows Missouri drivers to request an exemption and refund next fiscal year. And from July 1 2026 onward it will be 295 cents per gallon.

Fuel bought on or after Oct. 1 2021 through June 30 2022. This Non-Highway Use Motor Fuel Refund Application Form 4924 must be completed to substantiate your refund claims.

First state tax increase since 1996 adds 25 cents to the price of gasoline and diesel. Individuals who drive through or in Missouri could receive a refund for the increased gas taxes paid under a new plan put forth by Rep. Missouri receives fuel tax of 17 cents a gallon on motor fuel gasoline diesel fuel kerosene and blended fuel from licensed suppliers on a monthly basis.

Vehicle for highway use. How can I apply for a refund of the increased motor fuel tax rate for tax paid on motor fuel used for highway use. Retained in the Missouri Department of Revenues files.

This system provides information regarding the status of your Missouri tax return. You may be eligible to receive a refund of the 25 cents tax increase you pay on Missouri motor fuel if. After entering the below information you will also have the option of being notified by text or e-mail when the status of your tax return changes.

Senate Bill 262 you may be eligible to receive a refund of the 25 cents tax increase you pay on Missouri motor fuel in vehicles weighing less than 26000. On October 1 2021 Missouris motor fuel tax rate increased to 195 cents per gallon. This bill allows purchasers of motor fuel for highway use to request a refund of the Missouri motor fuel tax increase paid annually.

Irs Child Tax Credit Payments Start July 15

Income Tax Clip Art Bing Images Tax Preparation Credit Repair Business Credit Repair

How To Get A Missouri Gas Tax Refund As Gas Prices Increase

Cable Bill Spectrum Cable Bill Internet Phone Bill Template

Missouri Department Of Revenue Creating Refund Claim Form For Gas Tax

Here S Your Estimated 2022 Tax Refund Schedule

Tax Return Refund Delays From The Irs Leave Triangle Residents Waiting For Thousands Of Dollars Abc11 Raleigh Durham

Home Heating Tax Credit Utility Bill Payment Tax Credits Michigan

Missouri Gas Tax Refund Form 4925 Fill Online Printable Fillable Blank Pdffiller

Tax Deductions For Bloggers Money Blogging Make Money Blogging Blog Tips

Free Truck Dispatch Spreadsheet Db Excel Com Spreadsheet Template Excel Spreadsheets Templates Bookkeeping Templates

Missouri S Gas Tax Is Going Up How Much And When The Kansas City Star

Best Apps To Save On Gas For Your Car In 2021 Extreme Couponing Smart Money Cash Today

/cloudfront-us-east-1.images.arcpublishing.com/gray/ZW77UH7G7RG2HMO4GQZJCK2HC4.png)

Changes To Tax Benefits Could Boost Refunds For Many Families

It S Tax Season Use Your Refund To Jump Start Your Down Payment Savings Keeping Current Matters Tax Season Tax Refund Down Payment

How To Get A Missouri Gas Tax Refund As Gas Prices Increase

Pin By Jared Peterson On Lyft Business Tax Deductions Small Business Tax Deductions Tax Deductions

Gas Prices Explained Gas Prices Infographic Social Media Infographic